Financial Literacy is defined as “possessing the knowledge, skills, attitude, and abilities on financial matters to make effective and responsible decisions confidently and to make appropriate use of financial resources.” Financial Literacy is a worldwide challenge, as according to Standard & Poor’s Global Financial Survey, only 33% of the people worldwide are financially literate. Compared to this worldwide picture, the financial literacy rate in Pakistan is much lower. As per the Brookings Institution1, Pakistan is positioned at 16 among 26 nations with the lowest financial literacy ratings, with only 13% having formal bank accounts.

Recognising the urgent need to improve Financial Literacy (FL) amongst the masses, the State Bank of Pakistan (SBP) took the initiative to support and enhance the financial literacy ecosystem in Pakistan. As a result, two programmes were launched in the past decade, i.e., a National Financial Literacy Programme for the poor and marginalised men and women across the country – implemented by the State Bank of Pakistan; and the National Financial Literacy Programme for Youth (NFLP-Y) implemented by the National Institute of Banking and Finance (NIBAF). NFLP-Y was designed to strategically target and educate 20% of the more literate population, such that this 20% would generate 80% of the growth in the economy in the future. It targeted three age groups, i.e., 9-12, 13-17, and 18-19, through selected schools, colleges, and universities. The importance of FL for children and young adults is substantiated by the fact that financial attitudes, habits, and norms develop between the ages of 6 and 12. In this age bracket, students usually fall in grades 1 to 5. It was realised that FL could have a lasting impact on children and youth if they are taught about money and healthy money habits at this early age.

Financial Literacy

Financial Literacy

While there are now amazing success stories for the NFLP-Y project, the overall outreach was still limited to around 2 million children and youth. This begged the questions – why should such a worthwhile initiative be limited to 2 million children only? Why not expand financial literacy education to the whole of Pakistan? Why not integrate financial Literacy in the National Curriculum Framework at the primary and secondary level so that the concepts are mainstreamed in critical subjects and become part of the teaching and the textbooks, eventually benefitting every Pakistani child and youth?

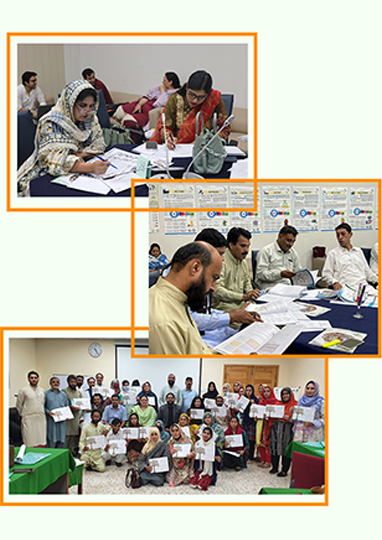

To this end the National Institute of Banking and Finance (NIBAF) announced a project in 2021, under the title of ‘Integration of Financial Literacy into the National Curriculum’. The purpose of this project was to develop an FL curriculum and integrate it into the national curriculum from primary to secondary level and pilot it in schools across the country through training teachers from different education systems. NIBAF engaged Pakistan Alliance for Early Childhood for this project through a competitive process and PAFEC achieved the set targets within the time frame of the project.